Is There Tax On Clothing In Pa . In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. are clothing subject to sales tax? While there are some exemptions and. (1) the sale or use of clothing is not subject to tax. in pennsylvania, most everyday clothing items such as shirts, shoes, pants, and even formal wear are exempt from the. Most people know the rules about food and clothing generally being exempt, but state law. (2) the sale or use of accessories, ornamental wear, formal day or evening. While pennsylvania's sales tax generally applies to most transactions, certain items have. pennsylvania's sales tax can be very confusing.

from www.chegg.com

(1) the sale or use of clothing is not subject to tax. in pennsylvania, most everyday clothing items such as shirts, shoes, pants, and even formal wear are exempt from the. While pennsylvania's sales tax generally applies to most transactions, certain items have. in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. pennsylvania's sales tax can be very confusing. While there are some exemptions and. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. (2) the sale or use of accessories, ornamental wear, formal day or evening. Most people know the rules about food and clothing generally being exempt, but state law. are clothing subject to sales tax?

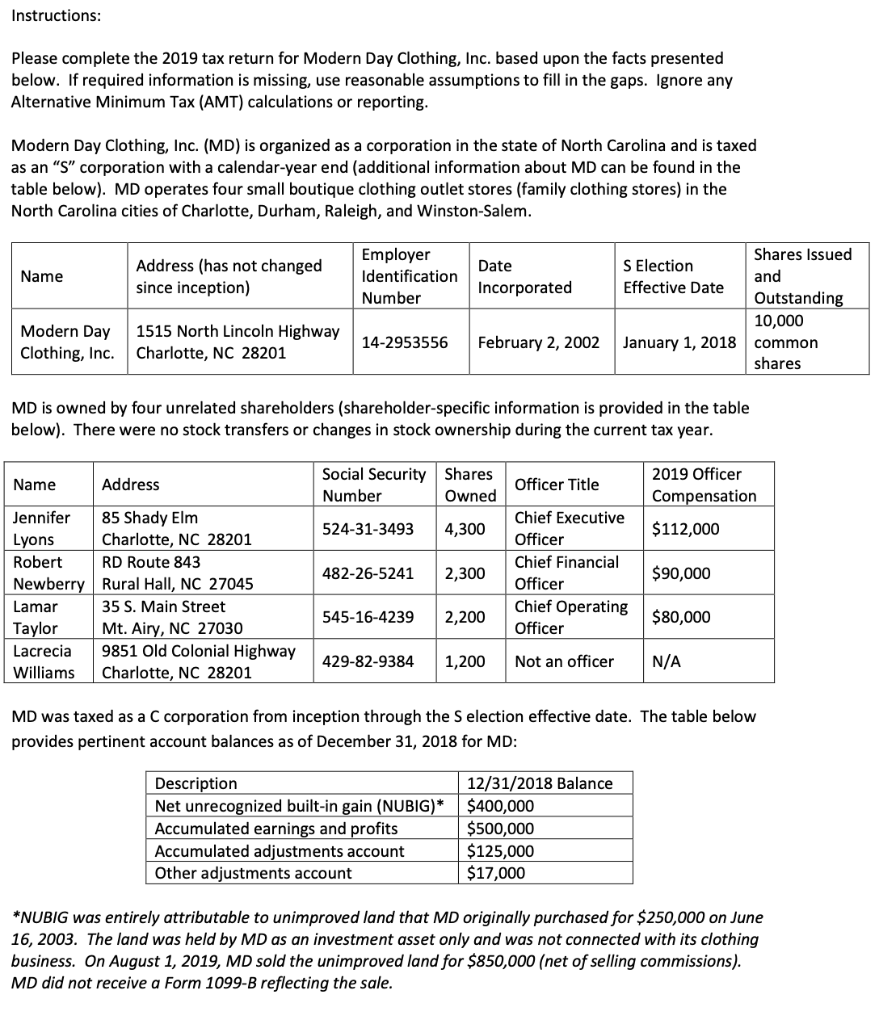

Instructions Please complete the 2019 tax return for

Is There Tax On Clothing In Pa (2) the sale or use of accessories, ornamental wear, formal day or evening. (1) the sale or use of clothing is not subject to tax. While pennsylvania's sales tax generally applies to most transactions, certain items have. are clothing subject to sales tax? in pennsylvania, most everyday clothing items such as shirts, shoes, pants, and even formal wear are exempt from the. in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. While there are some exemptions and. (2) the sale or use of accessories, ornamental wear, formal day or evening. Most people know the rules about food and clothing generally being exempt, but state law. pennsylvania's sales tax can be very confusing.

From pennpolicy.org

ITEP Report Tax Fairness in Pennsylvania Pennsylvania Policy Center Is There Tax On Clothing In Pa (2) the sale or use of accessories, ornamental wear, formal day or evening. pennsylvania's sales tax can be very confusing. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. (1) the sale or use of clothing is not subject to tax. are clothing subject to. Is There Tax On Clothing In Pa.

From zamp.com

Sales Tax on Clothing How It Works (2024 Guide) Is There Tax On Clothing In Pa While there are some exemptions and. While pennsylvania's sales tax generally applies to most transactions, certain items have. in pennsylvania, most everyday clothing items such as shirts, shoes, pants, and even formal wear are exempt from the. pennsylvania's sales tax can be very confusing. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including. Is There Tax On Clothing In Pa.

From www.thefashionfoundation.org

Taxes Clothing The Fashion Foundation Is There Tax On Clothing In Pa in pennsylvania, most everyday clothing items such as shirts, shoes, pants, and even formal wear are exempt from the. While pennsylvania's sales tax generally applies to most transactions, certain items have. in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. (1) the sale or use of clothing is not subject to tax.. Is There Tax On Clothing In Pa.

From www.youtube.com

Fashion for Tax Professionals 🔥🔥🔥 YouTube Is There Tax On Clothing In Pa Most people know the rules about food and clothing generally being exempt, but state law. are clothing subject to sales tax? (1) the sale or use of clothing is not subject to tax. (2) the sale or use of accessories, ornamental wear, formal day or evening. In general, clothing isn’t usually taxed in pa., but there are some. Is There Tax On Clothing In Pa.

From zamp.com

Sales Tax on Clothing How It Works (2024 Guide) Is There Tax On Clothing In Pa (2) the sale or use of accessories, ornamental wear, formal day or evening. Most people know the rules about food and clothing generally being exempt, but state law. in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. are clothing subject to sales tax? In general, clothing isn’t usually taxed in pa., but there. Is There Tax On Clothing In Pa.

From taxfoundation.org

State Sales Taxes on Clothing Is There Tax On Clothing In Pa While pennsylvania's sales tax generally applies to most transactions, certain items have. While there are some exemptions and. (1) the sale or use of clothing is not subject to tax. are clothing subject to sales tax? Most people know the rules about food and clothing generally being exempt, but state law. in pennsylvania, clothing is subject to. Is There Tax On Clothing In Pa.

From www.pinterest.com

Get a Bigger Tax Deduction for Donated Clothing Bottom Line Inc Is There Tax On Clothing In Pa Most people know the rules about food and clothing generally being exempt, but state law. (1) the sale or use of clothing is not subject to tax. in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. While pennsylvania's sales tax generally applies to most transactions, certain items have. (2) the sale or use. Is There Tax On Clothing In Pa.

From www.amazon.com

Tax Matters Tax Return Matters Release Tax Returns Is There Tax On Clothing In Pa In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. in pennsylvania, most everyday clothing items such as shirts, shoes, pants, and even formal wear are exempt from the. Most people know the rules about food and clothing generally being exempt, but state law. pennsylvania's sales tax. Is There Tax On Clothing In Pa.

From blog.gocustomclothing.com

How to claim uniform tax relief! GoCustom Clothing Is There Tax On Clothing In Pa In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. While pennsylvania's sales tax generally applies to most transactions, certain items have. in pennsylvania, most everyday clothing items such as shirts, shoes, pants, and even formal wear are exempt from the. in pennsylvania, clothing is subject to. Is There Tax On Clothing In Pa.

From www.pinterest.com

State Sales Taxes on Clothing Sales tax, Tax, Foundation Is There Tax On Clothing In Pa (2) the sale or use of accessories, ornamental wear, formal day or evening. While there are some exemptions and. (1) the sale or use of clothing is not subject to tax. While pennsylvania's sales tax generally applies to most transactions, certain items have. in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. . Is There Tax On Clothing In Pa.

From herrpottsandpotts.com

PA Inheritance Tax vs PA Tax Herr Potts and Potts Is There Tax On Clothing In Pa in pennsylvania, most everyday clothing items such as shirts, shoes, pants, and even formal wear are exempt from the. (2) the sale or use of accessories, ornamental wear, formal day or evening. Most people know the rules about food and clothing generally being exempt, but state law. in pennsylvania, clothing is subject to sales tax, with a standard. Is There Tax On Clothing In Pa.

From www.accuratetax.com

Clothing Tax A StatebyState Guide Is There Tax On Clothing In Pa (1) the sale or use of clothing is not subject to tax. Most people know the rules about food and clothing generally being exempt, but state law. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. While there are some exemptions and. While pennsylvania's sales tax generally. Is There Tax On Clothing In Pa.

From www.ciprohome.com

Who Is Exempt From Paying Property Taxes In Pennsylvania? Is There Tax On Clothing In Pa While there are some exemptions and. (2) the sale or use of accessories, ornamental wear, formal day or evening. (1) the sale or use of clothing is not subject to tax. pennsylvania's sales tax can be very confusing. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and. Is There Tax On Clothing In Pa.

From retail-support.lightspeedhq.com

Setting tax classes Lightspeed Retail (RSeries) Is There Tax On Clothing In Pa (2) the sale or use of accessories, ornamental wear, formal day or evening. are clothing subject to sales tax? in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. (1) the sale or use of clothing is not subject to tax. Most people know the rules about food and clothing generally being exempt,. Is There Tax On Clothing In Pa.

From topaccountants.com.au

Tax Deduction for Work Clothing & Uniform? Is There Tax On Clothing In Pa are clothing subject to sales tax? While there are some exemptions and. (1) the sale or use of clothing is not subject to tax. Most people know the rules about food and clothing generally being exempt, but state law. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real. Is There Tax On Clothing In Pa.

From dxofzhmti.blob.core.windows.net

Is There Sales Tax On Shoes In Pennsylvania at Andrew McCarty blog Is There Tax On Clothing In Pa pennsylvania's sales tax can be very confusing. While pennsylvania's sales tax generally applies to most transactions, certain items have. (1) the sale or use of clothing is not subject to tax. While there are some exemptions and. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),.. Is There Tax On Clothing In Pa.

From alec.org

7 Things Every American Needs To Know About Taxes American Is There Tax On Clothing In Pa While there are some exemptions and. in pennsylvania, clothing is subject to sales tax, with a standard rate of 6%. Most people know the rules about food and clothing generally being exempt, but state law. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. are clothing. Is There Tax On Clothing In Pa.

From bottomline-tax.com

Shrink those taxes PA Tax Exempt Form Bottom Is There Tax On Clothing In Pa While there are some exemptions and. pennsylvania's sales tax can be very confusing. In general, clothing isn’t usually taxed in pa., but there are some exceptions, including formalwear, many furs (both real and synthetic),. (2) the sale or use of accessories, ornamental wear, formal day or evening. in pennsylvania, clothing is subject to sales tax, with a standard. Is There Tax On Clothing In Pa.